If you want to fund your extraordinarily risky vision in the Valley, you will give up equity, not future income streams that are much less than certain. Start-ups generally don’t perform, which is why capital has long been so expensive in northern California.

After which, it’s useful to add that the banks that the Fed projects its well-oversold influence through cannot go anywhere near Valley start-ups as is. massively overstate the role of the Fed in the economy. It’s all a simple reminder of how very much Left, Right and Center in the U.S. Let’s try to be reasonable in the way The Lords is not. This rates constant stress given Leonard’s obvious belief that the Fed is the size credit dealer, deciding with rate fiddling when an economy should grow, and when it shouldn’t. Talent, and the investment that follows the talent is what causes prosperity, not central banks. It can’t make Detroit prosperous, nor can it make the Valley poor. Reversing the above scenario, what if the Fed aggressively sold bonds to Valley banks as a way of shrinking so-called “money supply.” Does any serious person really think that domestic and global sources of capital relentlessly in search of returns wouldn’t have reversed just this kind of central-bank action in a matter of minutes? What Greenspan did, and that Leonard oddly deemed consequential, was irrelevant given the globalized nature of capital obsessively in search of returns. To Leonard’s facile mind, the answers are easy. When the Fed lowers interest rates, it speeds up the economy.” It’s so simple! More on this bit of nonsense in a bit, but for now one has to wonder why Haiti doesn’t set up a powerful central bank to fix its problems.

How about an airlift of Leonard’s book to Port-Au-Prince? According to the journalist, “When the Fed raises interest rates, it slows the economy. Apparently Haiti didn’t get this memo about how easy it is to prosper. Speaking of Silicon Valley, Leonard equates “cutting rates” with economic growth as through the Fed has an ability to turn vitality on and off with the proverbial light switch. A prosperous, Silicon Valley-like past isn’t a lure for return-seeking capital in the present. It exits, and without the stimulus that Leonard imagines. If the latter is scarce, the money serves no purpose. Leonard promotes the comical falsehood throughout his book (from now on titled, The Lords) that “the Fed’s one superpower is its ability to create new dollars and pump them into the banking system.” All of which is utterly meaningless and economically inconsequential without production.

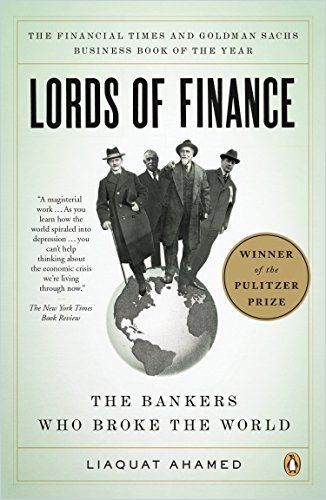

All of this and much more came to mind while reading Christopher Leonard’s wholly confused new book, The Lords of Easy Money: How the Federal Reserve Broke the American Economy.

0 kommentar(er)

0 kommentar(er)